Overview

The digitalization of financial services opens up exciting possibilities for creating a more inclusive system that serves traditionally excluded and marginalized groups, including women. By increasing efficiency and access and developing tailored products, digital financial services (DFS) can be a powerful tool for advancing women’s financial inclusion.

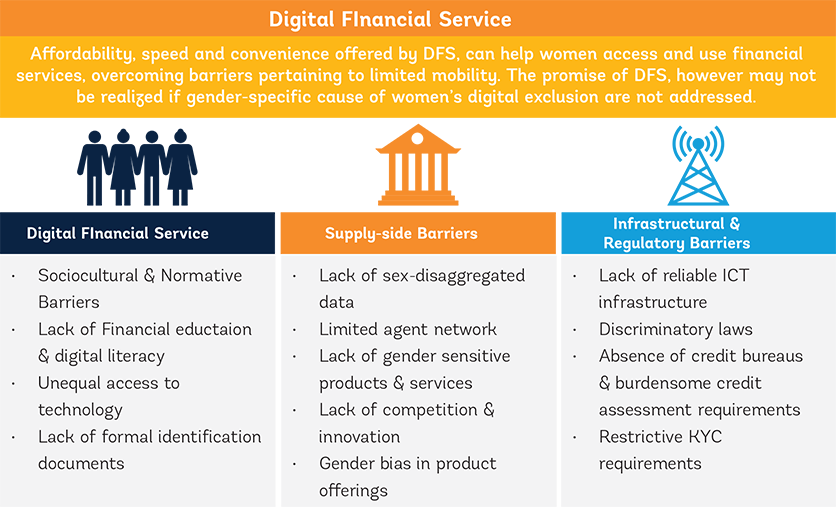

Digital financial inclusion barriers

While DFS offer immense potential to advance women’s financial inclusion, women often encounter gender-specific challenges in accessing DFS that necessitate deliberate and gender-informed policy making.3 These barriers can be divided into the following three broad categories:4

Barriers Specific to Women’s Digital Financial Inclusion

World Bank

3. Gender-neutral legislation/regulation: Legislation that is drafted in universal terms, ignoring gender-specific situations and power relations between women and men that underpin sex-and gender-based discrimination, including gender-based violence against women.

4. Adapted from AFI (2019) and Pazarbasioglu et al. (2020).

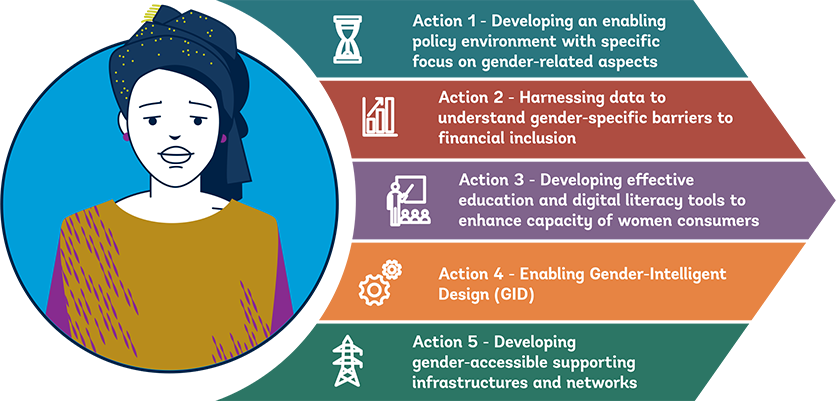

Strategies to address barriers

Unequal opportunities, structural hurdles, and social norms all contribute to a persistent digital gender divide and dictate the way men and women interact with technology. The overlapping nature of the barriers discussed in section 1.1 increases the likelihood that women will be excluded from opportunities brought about by the digitalization of finance and prevented from bridging this gap.

In this context, a gender-agnostic approach to DFS is not likely to yield desirable results.

Authorities need to develop a systemic and gender-intelligent approach7 to digital financial inclusion to ensure that women are provided a platform to reap the benefits of digitalization. This holistic approach looks at financial inclusion from different angles—including supply and demand for services, supporting infrastructure, and an enabling environment— and through a gender-sensitive lens, with the objective of identifying pain points for the target group and paving the road to a reformed agenda.

A systemic approach intends to move the whole system toward a new equilibrium that works better for the target group. This means that all market actors (public, private, infrastructural, informal) adopt new behaviors (for example, adopting innovative product-design processes to ensure inclusivity or employing a gender lens in market research) or collectively adapt their practices to lead to improved participation of low-income populations in financial services markets.

Source:CGAP (Consultative Group to Assist the Poor), “Systemic Approach to Financial Inclusion” (online course), https://www.cgap.org/topics/collections/market-systems-approach

CGAP (Consultative Group to Assist the Poor), “Systemic Approach to Financial Inclusion” (online course), https://www.cgap.org/topics/collections/market-systems-approach.

This subsection outlines a set of five action areas for policy makers to improve analysis of the barriers to women’s digital financial inclusion and recommends reforms to level the playing field for women consumers.

Action Areas

World Bank

Developing a strategic roadmap

It is important to note that the prioritization of these tools may vary depending on the jurisdiction. The specific context, challenges, and opportunities within each country or region will determine the relevance and significance of different tools. Therefore, authorities and policy makers should carefully assess their own jurisdiction’s needs and tailor the implementation of these tools accordingly. Accounting for the unique circumstances of each jurisdiction will help ensure that the approach to women’s digital financial inclusion is effective and responsive to the specific barriers and opportunities present in that context. Additionally, authorities should consider gender practices within their institutions to enhance internal capabilities and promote gender equality.

Resources for Policy Makers

The Center for Global Development’s Decision Tree Framework presents a new methodology. Adaptable to country-specific settings, it will help policy makers, researchers, and other stakeholders to diagnose the binding constraints and limiting factors impeding further digital financial inclusion.

The Alliance for Financial Inclusion’s Toolkit on Gender Inclusive Policy Development is designed to help policy makers develop a common understanding of relevant gender concepts and provide practical guidance on designing gender-inclusive policies to increase the level of access and usage of formal financial services by women in their jurisdictions.

An Analytical Approach to Building an Inclusive and Sustainable DFS Ecosystem

Authorities can take the following steps to build an effective framework toward women’s financial inclusion:

- Assess the landscape.

- Identify and prioriize key areas and tools for intervention.

- Develop a partnership model to ensure stakeholder collaboration and cross-pollination.

- Ensure cross-cutting Monitoring & Evaluation.

Building an Effective Approach for Women’s Digital Financial Inclusion

World Bank

-

Read MoreBuild a partnership model

Structure stakeholders into a workable partnership model for institutional collaboration and cross-pollination.

Build a partnership model

Build a partnership model

-

Read MoreIdentify & prioritize key areas of intervention

Identify strategic areas of intervention that warrant priority, to kickstart the women’s digital financial inclusion agenda.

Identify & prioritize key areas of intervention

Identify & prioritize key areas of intervention

Conclusion

Policy makers have a crucial role to play in promoting digital financial inclusion for women, which is vital for achieving gender equality and economic growth. Access to DFS can provide women with greater control over their financial lives, help them build resilience against shocks, invest in their businesses, and improve their overall economic well-being. The Global Findex Database 2021 offers hope of what concentrated efforts to advance women’s financial inclusion can do, demonstrating that the gap in access to financial services between men and women has narrowed after years of stagnation. Globally, 74 percent of women now have an account, compared to 78 percent of men, displaying a gender gap of four percentage points, a drop of three percentage points since 2017.

However, despite significant progress in recent years, women still face many challenges in accessing and using DFS. These challenges include low levels of financial literacy, limited access to technology and the internet, and social and cultural norms that restrict women’s mobility and economic participation.

Owing to the unique barriers that women face in accessing and using DFS, it is imperative that policy makers adopt gender-sensitive policies designed with a gender lens and informed by data on women’s financial behaviors and needs. Policy makers should consider measures such as improving financial literacy and digital skills among women, promoting gender-responsive financial services and products, and expanding access to digital infrastructure and technology.

In order to ensure the effectiveness of these policies, policy makers should actively engage with women and women’s organizations to ensure that their voices are heard and perspectives included in policy design and implementation. By including women in the decision-making process, policy makers can better understand the specific challenges faced by women and tailor solutions to meet their needs. Ultimately, promoting digital financial inclusion for women requires a comprehensive approach that addresses the multifaceted barriers they face and empowers them to participate fully in the digital economy.