Develop Effective Education and Literacy Tools to Enhance the Capacity of Women Consumers

Suggested Approaches

- Identify, engage, and organize stakeholders working on literacy-related issues.

- Incorporate digital financial literacy (DFL) objectives and targets in the NFIS.

- Ensure that DFL initiatives reflect the local context and are not cut-and-paste efforts from other markets.

Establishing a good level of digital and financial literacy should be an integral aspect of any strategy to increase the use of DFS among women. However, women come to financial services with diverse experiences and skill sets, and any DFL initiative must meet women where they are. The education and awareness programming that DFL entails must resonate with those using it, taking a user-centric approach, addressing language, context, social norms, and other critical factors that inform a women’s familiarity, adoption, and use of DFS.

Nonbank financial institutions: In some geographies, these entities are the only means of formal/semiformal financial inclusion that women have. As these institutions increasingly digitize, they have an incentive and role to play in improving DFL among their members.

Agents (either through FSPs or as independents/banking agents) can offer lessons and guidance on DFS functionality within the areas where they work. (Note: This can become burdensome on independent agents who spend much time carrying out this training and are not compensated for it).

Community-based initiatives: Community-based initiatives, such as digital literacy centers, are also designed to provide access to digital literacy education and resources to women and marginalized groups.

Policy makers can play a crucial role in ensuring that women’s DFL is also prioritized. Policy makers are in a position to play a unique coordination role among FSPs and other stakeholders, to ensure that DFL efforts are effectively designed to build toward overall confidence among women users, rather than an understanding around a singular product. Key aspects of this role are outlined below.

Identify, engage, and organize stakeholders working on literacy-related issues

In a given country context, a wide range of stakeholders are often engaged in the delivery of financial literacy. Financial-sector authorities should take responsibility for propelling the DFL agenda forward, and for engaging and coordinating other stakeholders to ensure a cohesive approach to financial literacy.

These stakeholders include the following:

- FSPs and other private companies that can offer DFL directly to customers as they launch and distribute different products and services.

- Government ministries (for example, education, health, community services) that offer specific DFL training focused on a particular product or service (such as a social safety net payment, or payment product).

- Nonprofit organizations that deliver services through digital technologies.

- Nonbank financial institutions, which in some geographies are the only means of formal/semiformal financial inclusion that women have. As these institutions increasingly digitize, they have an incentive and a role to play in improving DFL among their members.

- Mobile network operators sometimes provide training around the mobile money or mobile wallet functions they offer.

- Agents (either through FSPs or as independents/banking agents) can offer lessons and guidance on DFS functionality within the areas where they work. (Note: This can become burdensome on independent agents who spend much time carrying out this training and are not compensated for it).

- Community-based initiatives, such as digital literacy centers, are also designed to provide access to digital literacy education and resources to women and marginalized groups.

Country Examples

Leveraging Technology for Collecting Supply-Side Data

In Papua New Guinea, the central bank (Bank of Papua New Guinea) partnered with the United Nations Capital Development Fund, the PNG Insurance Council, and 15 insurance providers to develop a campaign to improve awareness, understanding, and adoption of insurance products. This coordinated action by the Bank of Papua New Guinea meant that consumers did not learn about a singular branded product, but about the general concept of insurance and a suite of different insurance products.

Develop policy tools, such as an NFIS, to coordinate activities

The following actions can be covered within the strategy:

- Establishing an understanding of the current key DFL competency levels for women within their market and identifying the key areas to be prioritized.

- Requiring FSPs to provide training, and mandating that products and services come with accessible instruction and address prioritized competencies. For example, the NFIS of Bangladesh has instructed all banks to increase the level of financial literacy among women entrepreneurs.

- Requiring FSPs to offer customer service staff/ambassadors to provide in-person support throughout the learning process and ethical behavior toward women customers.

- Selecting core themes that FSPs need to address within their DFL efforts.

Ensure that initiatives are sensitive to culture, context, and language

To tailor DFL tools to women, policy makers should advocate for the following gender-intelligent approaches:

- Being mindful of women’s literacy and numeracy levels. Most DFS, whether delivered through basic or smartphones, require some degree of literacy or numeracy, which can limit their accessibility and usage by women with low levels of literacy, digital or otherwise.

- Rather than limiting DFL efforts to a single channel, using a multipronged approach to ensure that the message is emphasized and takes different learning styles into account.

- Creating a “learning ladder” that segments different DFS functions (from beginner to advanced) and frames DFL as a progressive journey, allowing women to understand where they are in the journey without being overwhelmed.

- Understanding that, because women are less likely to have mobile phones than men, they may be less comfortable if their learning is solely through a digital device (through mobile literacy/learning apps, and so on). Policy makers should champion “phygital” approaches that combine physical (in-person) and digital learning to improve women’s digital literacy, offering a space comfortable to all.

- Encouraging FSPs to use women facilitators and teachers for in-person DFL efforts, urging providers to hold training in locations that are appropriate and welcoming for women, and potentially providing childcare or other support to ensure that women are able to attend and absorb information.

- Requiring DFS providers to share product-agnostic content that isn’t biased toward one product over another but builds broad DFL and capability, potentially through standardized content or modules provided by the policy maker.

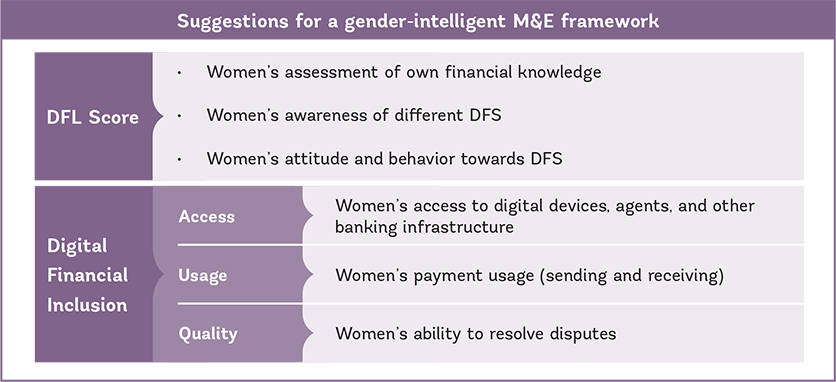

Establish gender-specific DFL targets

Establish gender-specific DFL targets that accomplish the following:

- Tie DFL to women’s access and usage targets, as illustrated in the suggested monitoring and evaluation (M&E) framework below.

- Require FSPs to collect and report data on women’s usage patterns.

- Integrate DFL-specific goals and targets into the NFIS.

Suggestions for a Gender-Intelligent M&E Framework

IMPORTANT TO REMEMBER

Policy makers aiming to utilize financial and digital literacy tools to support greater inclusion for women must also ensure that sufficient resources—financial and otherwise— are allocated to create gender-specific literacy tools.

Ring-fencing budgets are important; literacy training is a costly exercise and requires long-term outreach and efforts to increase meaningful and sustainable familiarity and usage of DFS.

Country Examples

Government Social Safety Net Cash Transfer

The Government of Bangladesh’s Social Safety Net Program was experiencing lower levels of uptake among women beneficiaries in Sathkira District and engaged the United Nations Development Programme (UNDP) to improve support for women’s financial inclusion. Aflatoun, a nongovernmental organization focused on children’s financial education, designed a financial literacy curriculum and training for the Bank Asia mobile phone application to address this issue. Aflatoun trained Bank Asia’s agent banks and UNDP field facilitators, who then used participatory learning methods—such as dramas, group work, role play, and games-over several structured one-hour lessons to train groups of 10 women beneficiaries.

During the six-month program, Aflatoun trained 36 agent banks and UNDP facilitators, who in turn trained approximately 3,240 women beneficiaries, who then accessed the Social Safety Net Program through “human ATMs,” or agents. Bank Asia also commercialized the concept, turning it into a lucrative profession for many beneficiaries.