Brief background and scope of the topic which will clarify that this only deals with new and enhanced risks from Financial Consumer Protection.

Background and Scope

- Background: The widespread uptake of digital financial services has heightened risks for consumers and raised new policy concerns. Determining consumer protection measures that may help to address these new manifestations of risks; these challenges are even tougher for policymakers in countries that are also under pressure to develop or strengthen Financial Consumer Protection in their jurisdictions more broadly.

- What this reference guide does: Serves as a practical reference guide for regulators and policymakers by identifying new and enhanced consumer risks posed by digital finance and providing a range of emerging policy approaches that can be used to address them.

Overview Financial Consumer Protection

Financial Consumer Protection is an increasing priority for policymakers around the world, as its own policy objective and as a contributing factor to the healthy development of the financial sector, financial inclusion, and broader economic growth. Protecting consumers from abusive practices and enabling them to make well-informed decisions regarding the use of financial products and services is an important policy goal in and of itself, but also has implications for the healthy development of the financial sector, financial inclusion, and broader economic growth. It is a cross-cutting topic with relevance across all types of financial service providers and financial products and services.

A strong consumer protection regime is key to ensuring that expanded access to financial services benefits consumers, enabling them to make well-informed decisions on how best to use financial services, building trust in the formal financial sector, and contributing to healthy and competitive financial markets. The global financial crisis of 2008 highlighted the importance of Financial Consumer Protection for the long-term stability of the world financial system. The need for financial stability, financial integrity, financial inclusion, and Financial Consumer Protection objectives to complement one another has become an increasingly common theme highlighted by global policy makers in recent years. Significant advances have been made in Financial Consumer Protection across the globe. In both developed and developing countries, policy makers are establishing and strengthening legal and regulatory frameworks for Financial Consumer Protection and building up specialized supervisory departments.

Numerous global bodies have issued guidance on Financial Consumer Protection, including both high-level principles as well as more detailed guidance. The World Bank’s 2017 Good Practices for Financial Consumer Protection was developed as a contribution to the emerging global set of tools on Financial Consumer Protection. It serves as a comprehensive reference and assessment tool to assist policy makers, its primary audience. The report consolidates good practices from international guidance and country examples, accompanying them with practical information on policy considerations for implementation. A policy research paper on Consumer Risks in Fintech further adds to the 2017 Good Practices by identifying new manifestations of consumer risks and emerging policy approaches.

While this section of the reference focuses on new and enhanced consumer risks from digital financial services, a broader list of resources on Financial Consumer Protection may be found below.

Additional Examples of Selected Product Specific risks from DFS

Complaints handling and dispute resolution

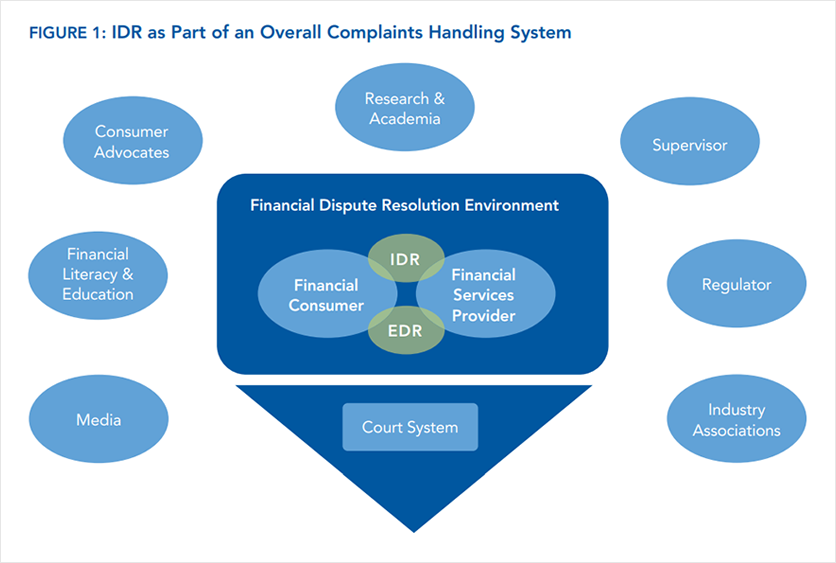

As the DFS ecosystem continues to expand with more services and products available to consumers, it becomes increasingly essential to have effective recourse mechanisms in place. An accessible and efficient recourse mechanism that allows consumers both to know and to assert their rights to have their complaints addressed and resolved in a transparent and just way within a reasonable timeframe is essential. Financial consumer complaints handling mechanisms comprise two stages:

- Complaints that are handled by financial service providers, generally referred to as internal dispute resolution (IDR).

- Complaints that, if not satisfactorily resolved, are handled by an alternative, out-of-court process, generally referred to as external dispute resolution.

World Bank(2019)

Effective dispute resolutions are not only important in improving trust and adoption for consumers, but the wealth of information that can be collected and analysed offers an opportunity to improve products and services. An IDR mechanism is defined as a complaints handling function, unit, or dedicated team within a financial service provider. The complaints handling should be handled by the IDR mechanism in a prompt, effective, and just way. IDR mechanisms seek to provide a means by which consumers can obtain a solution to any deficiency in service or product, including obtaining compensation, when applicable.

A few key considerations while designing an effective IDR framework are: