Assess the landscape

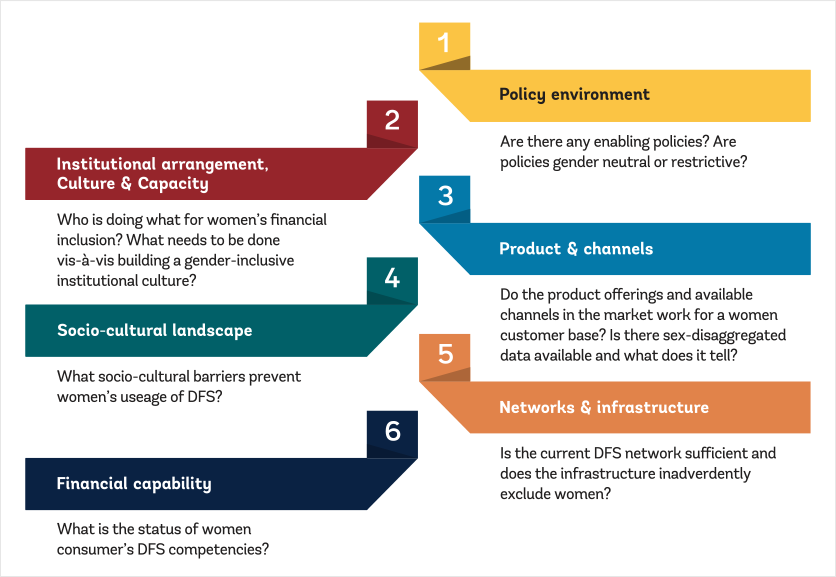

Start by evaluating women’s financial inclusion as the foundation of any policy framework. Engage all stakeholders, including women consumers, FSPs, and government institutions involved in large-scale financial services, such as cash-transfer programs. An exhaustive assessment should cover each of the six areas shown in Figure 11—that is, policy environment, institutional capacity, product offerings, sociocultural factors, networks and infrastructure, and financial capability.

Key tip 1: Utilize sex-disaggregated data to garner insights on various women’s groups

Policy makers can effectively use guidance provided under Action 2, “Harness Data to Understand Gender-Specific Barriers to Financial Inclusion” to inform policy design and interventions. This data analysis enables the development of gender-sensitive policies, including financial education programs, microfinance schemes, and affirmative action policies. The regulators may refer to the non-exhaustive list of guiding questions in appendix B to assess the financial sector’s readiness for gender-inclusive interventions.

Assessing Financial-Sector Space to Identify Barriers to Women’s Financial Inclusion

World Bank

Key tip 2: Strengthen internal capacity to address gender-specific barriers

To enhance policy makers’ ability to identify and address gender-specific barriers to financial inclusion, they need to prioritize two key areas: building internal capacity within their organizations and improving gender representation in senior management. By doing so, they can ensure a comprehensive understanding of women’s use of DFS and recognize the significance of financial inclusion. Therefore, it is crucial to make conscious efforts to develop and enhance internal capabilities to assess and overcome these barriers.

Various studies, including the International Monetary Fund’s study on women in leadership, have demonstrated that a higher representation of women in senior positions within banking supervision agencies leads to greater bank stability and resilience. This highlights the importance of diverse perspectives and voices when it comes to DFS. By incorporating gender diversity, policy makers can facilitate gender-sensitive policy development and create products and services that cater to the needs of all individuals. Ultimately, this fosters an inclusive financial ecosystem that benefits everyone.