Overview

- Marketplace lending is often described as one of the most significant developments in fintech, although its basic elements are not new. From a lending-product perspective, consumer peer-to-peer loans are typically unsecured, amortizing loans, very similar to personal installment loans provided by traditional lenders such as banks and finance companies.

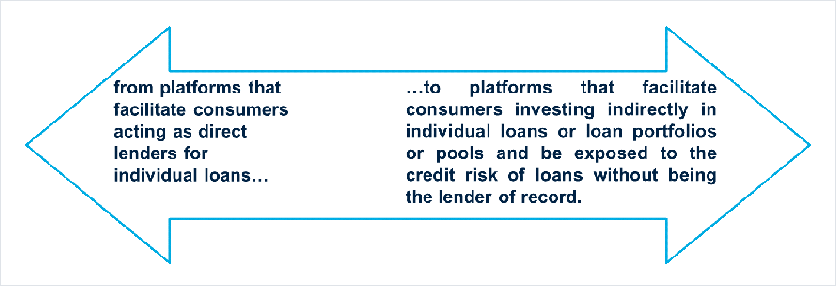

- From an investment perspective, the concept of investing in loans made by another lender also is not new, given the range of arrangements—such as loan securitization—that have allowed third-party investment long before marketplace lending developed. The key innovation represented by marketplace lending and facilitated by technology—specifically by online platforms—has been to give prospective borrowers, particularly consumer borrowers, access to potential lenders that they did not have before. As a result, it can offer alternative sources of funding for consumers to more traditional channels. Similarly, from a lender/investor perspective, and particularly from a consumer investor perspective, it has given consumers access to investment opportunities in loans that they formerly did not have.

- Many terms have been used internationally to describe this form of lending – for example: marketplace lending, peer-to-peer lending, loan-based crowdfunding, crowdlending, social lending etc. –encompassing many business models.

Provision of credit facilitated by online platforms that match borrowers with lenders, encompassing a spectrum

Conflicts of interest

| Risks | Possible regulatory approaches |

|---|---|

Conflicts of interest between operators (or their related parties) and lenders/investors or borrowers may lead operators to engage in conduct not in the interests of consumers – for example:

|

|

Fraud or other misconduct

| Risks | Possible regulatory approaches |

|---|---|

Consumers may suffer loss due to:

Note: Such risks are not unique to marketplace lending, but various aspects of marketplace lending’s development, and its relative novelty, can contribute to their increase. See Country Example The EBA made the point that it might be difficult for lenders/investors and borrowers in a particular jurisdiction to find independent information about the reputation of platforms where operators do not require regulatory permissions to operate platforms and are not subject to legal information or disclosure requirements. In China, prior to recent reforms, it was frequently highlighted that there had been low barriers to entry, meaning the quality of sector participants varied significantly, creating major risks for participants. By the end of 2017, following a significant tightening of regulation (which some have criticized), 3,600 platforms had already discontinued operations, as many had difficulty in meeting clients’ demands for cash withdrawals or had management abandon the business. |

|

Platform / technology unreliability or vulnerability

| Risks | Possible regulatory approaches |

|---|---|

Consumers frequently face some risk of harm or loss from:

Note: A working group of BIS’ Committee on the Global Financial System noted that fintech credit platforms may be more vulnerable than banks to certain operational risks, such as cyber risk, due to their reliance on relatively new digital processes. The extent of such risks to platforms is likely to depend on a number of factors, including the platform operators’ level of sophistication, mechanisms used for storing client information, and the robustness of cybersecurity arrangements. |

|

Business failure or insolvency of platform operator

| Risks | Possible regulatory approaches |

|---|---|

|

|

Additional risks for borrowers

| Risks | Possible regulatory approaches |

|---|---|

| Borrowers not receiving adequate information to understand rights and obligations under peer-to-peer loans, including if marketplace lending is not adequately covered by existing credit disclosure/transparency requirements. |

|