Proportionality

Consider the size, type, and complexity of financial service providers that will be implementing such requirements, and bring, to the extent feasible, a proportional approach that balances the requirements with the scale of operations and range of activities undertaken by financial service providers. Minimum regulatory requirements regarding the internal procedures for handling complaints and the dissemination of related information should exist and should be similar at least across regulated entities undertaking similar activities and offering similar services.

Policies and Procedures

Written complaints management policies and corresponding processes, procedures, and systems for the proper and impartial handling and resolution of consumer complaints should be included, and applied to third parties to whom this function has been outsourced. The documented policies should, at a minimum, (i) ensure the accessibility, fairness, transparency, responsiveness, and independence of the complaints handling mechanism; (ii) be approved.

Access to Complaints: Channels, Visibility, and Transparency

Financial service providers should make available multiple channels for lodging complaints, taking into consideration the customer needs to be served. Channels should be functional, accessible, and efficient. The complaints handling service should be free of charge to consumers and should enable a complaint to be submitted by consumers via oral or written formats. Once financial service providers have put in place formalized, written policies regarding their complaints handling and implemented processes, procedures, and systems, disclosure initiatives should be undertaken to inform consumers about their rights and how to exercise them. To this end, financial service providers should disclose to consumers not only the complaints handling procedures and communication channels to be used but also escalation processes.

Timelines

Mandatory time limits help ensure that all complaints are handled in a timely manner and can provide confidence to consumers that their complaints will be resolved by the financial service provider in a reasonable time. Threshold limits encourage financial service providers to manage complaints properly, as violations can be addressed with fines or moral suasion responses.

Consumer Communication

Financial service providers should have procedures in place to provide complainants with immediate written acknowledgment of receipt of the complaint. Consumers should be informed of the expected timing for processing the complaint, including the maximum period within which the provider will give a final response, along with the expected medium of response.

Coordination between the financial and telecom regulators in dispute resolution

Close coordination and collaboration between the financial and telecom regulators (including sharing data and analysis on DFS complaints) ensures effective resolution. This information can also inform their DFS-related licensing, supervision/oversight, and enforcement roles.

Complaints Data Recording and Reporting

Employees should be trained and provided with scripts/procedures for the most common complaints received. Moreover, the categorization of complaints makes handling disputes more efficient. Information about previous complaints should be accessible by all complaints handling staff, subject to the conflicts and privacy legal and regulatory framework. As the database should record classifications of complaints and their resultant resolutions, a regular assessment of uniformity should be readily performed.

Supervision

Financial regulator or supervisor has the remit to monitor complaints and listen to and resolve disputes. This can include providers sharing complaints data with the regulator and/or onsite checks for compliance.

Alternate dispute resolution or external recourse

Consumers who are not satisfied with how their complaint was handled by their provider are able to access alternative or external channels to seek redress. Information on how to use alternative methods is readily available.

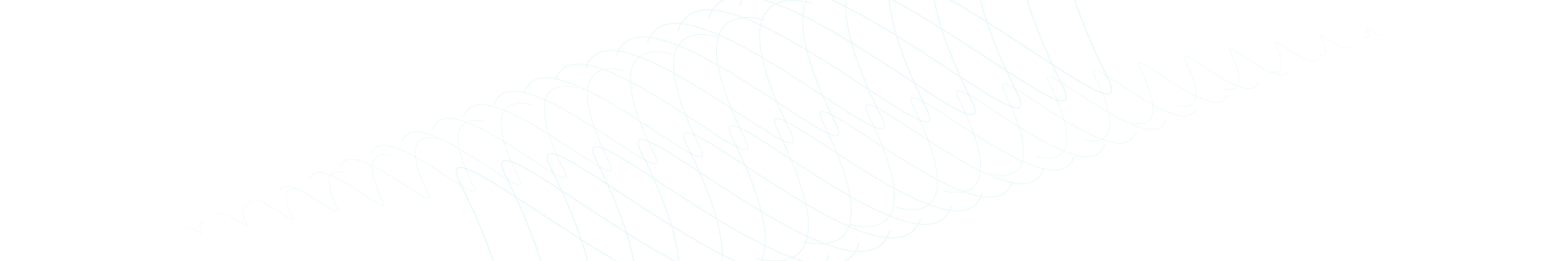

The Bank of Ghana has provided a poster template to be displayed at points of contact with consumers. The template requires that financial service providers disclose their contact details and include a brief description of the escalation process to follow in case of dissatisfaction with the resolution.

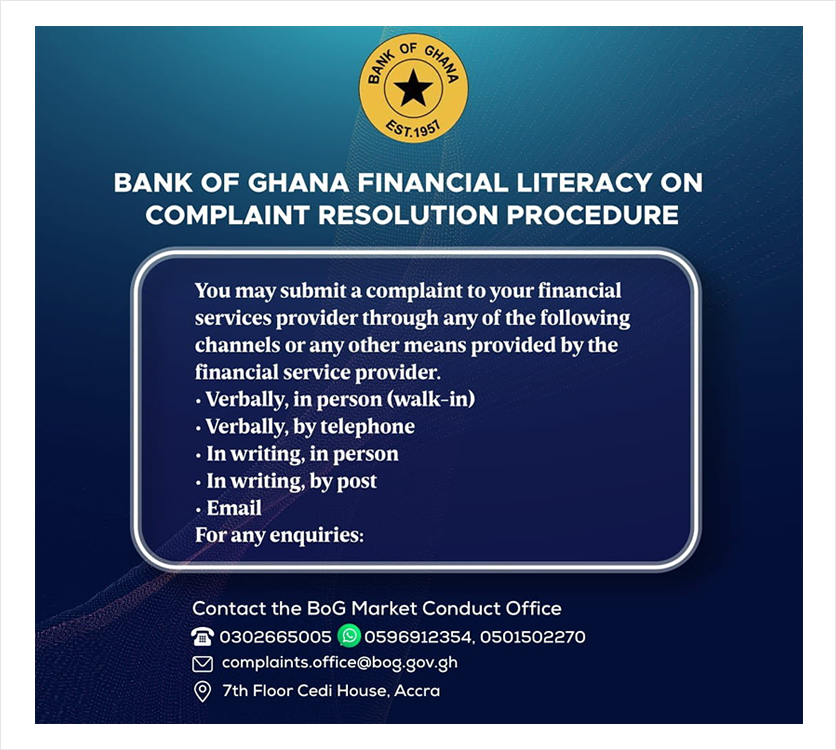

The Bank of Ghana also has its own educational material on IDR:

Several examples of international principles highlight the consensus that digital financial service providers should have in place complaints handling and resolution processes and procedures that are efficient, prompt, and fair.

- Guideline 8 of the Better Than Cash Alliance’s Responsible Digital Payments Guidelines of 2016 stresses that the recourse system should be accessible by phone or digitally, such as via a website or by text message, or by visiting the provider’s place of business.

- The GSMA Code of Conduct for Mobile Money Providers emphasizes the need for complaints resolution processes and procedures. Specifically, Principle 7 of the code underscores the need to have in place mechanisms to ensure that complaints are addressed effectively, and problems are resolved in a timely manner, and it points out the need to inform consumers of the complaints policies and procedures.

- The ITU-T’s Commonly identified consumer protection themes for digital financial services, 2019 emphasizes the following: complaints policy and procedures in place, transparent, and communicated to consumers; multiple recourse channels available to consumers; alternative dispute resolutions or external recourse available; reasonable timeframe provided for dispute resolution, communicated to consumers; coordination between the financial and telecommunications regulators in dispute resolution; oversight of the recourse system by the financial regulator or supervisor; and employees and agents are trained in handling disputes.

- Good practices related to IDR have been discussed in the World Bank’s paper on Complaints Handling within Financial Service Providers.

- In addition to allowing consumers to have their issues resolved in an efficient, fair, and transparent way, IDR mechanisms can provide regulators and supervisors with important complaints-related data to help them conduct evidence-based policy making and prioritize their supervisory activities by identifying systemic problems with products, providers, channels, or systems.