Defining Digital Financial Services

Digital Financial Services

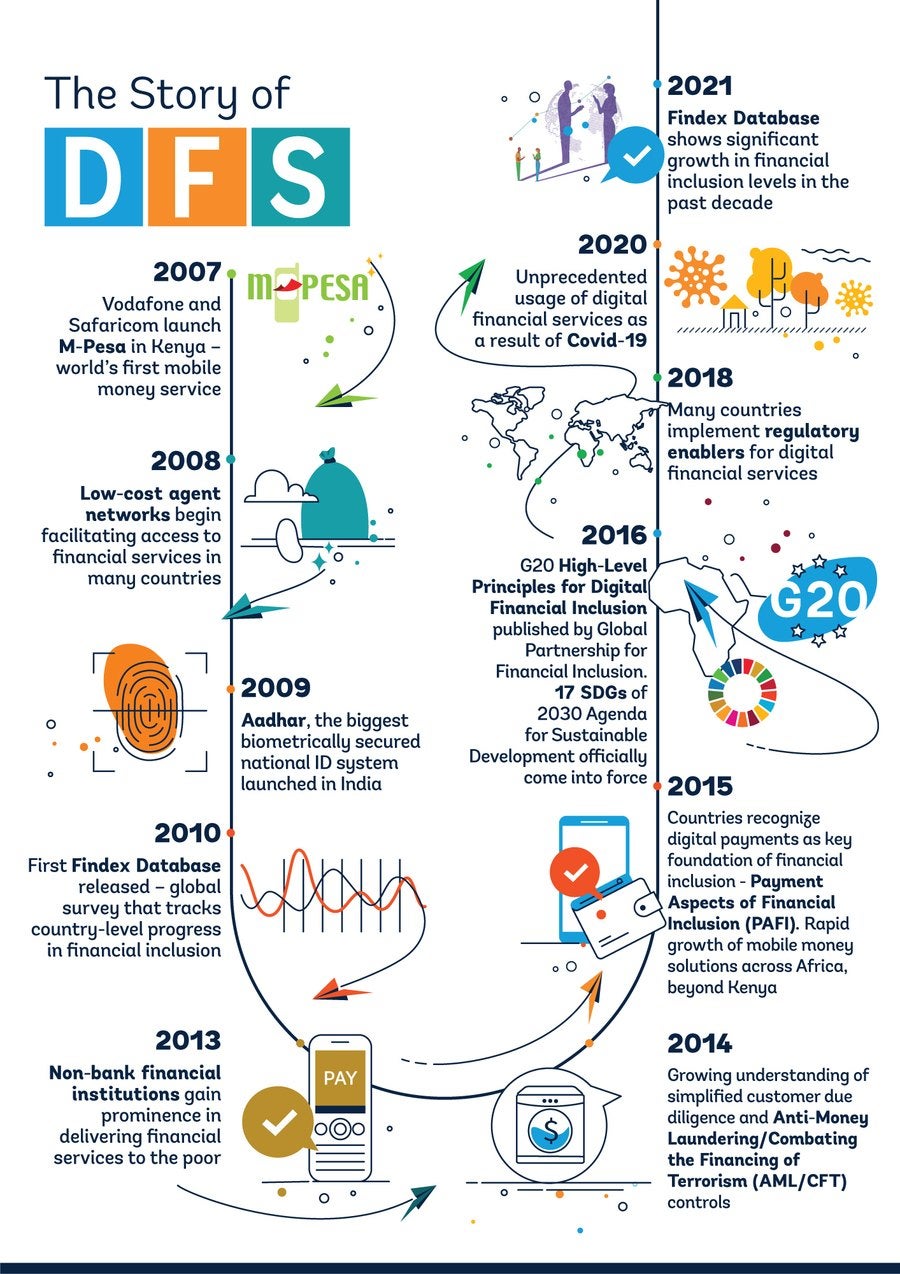

Digital Financial Services (DFS) are financial services that rely on digital technologies for their delivery and utilization by consumers. These services leverage digital platforms, such as mobile devices and the internet, to provide convenient, accessible, and secure financial solutions. DFS encompass a wide range of financial activities and products, including electronic money, digital wallets, and digital payment platforms, loans, savings, insurance, and investment. By harnessing digital technologies, DFS enable individuals and businesses to conduct financial transactions, access financial products, and manage their finances more efficiently and effectively. The use of digital technologies in DFS promotes financial inclusion by reaching underserved market segments, and drives innovation in the financial sector.

Fintech (Financial Technology)

Fintech (Financial Technology) is a broader term that encompasses the use of technology to innovate and transform various aspects of the financial industry. Fintech utilizes digital technologies like data analytics, quantum computing, cloud services, machine learning, artificial intelligence, and distributed ledger technology, to enhance financial activities.

DFS provider

A DFS provider is a financial service provider that delivers digital financial services to customers. In this guide, a DFS provider may include traditional financial sector intermediaries like banks and insurance companies in cases where considerations and tools may be applicable. More broadly, DFS providers may include electronic money issuers, fintech firms, and other regulated entities delivering DFS.

DFS And Financial Inclusion

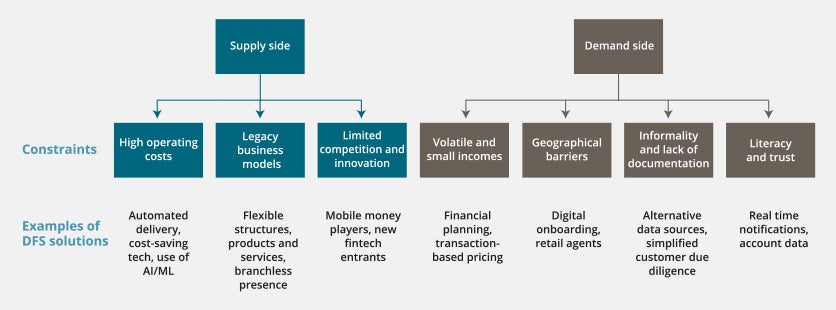

DFS has the potential to overcome long standing barriers to access and usage faced by unserved individuals and firms. It can also provide convenient access to faster, cheaper, more customized products to those who are underserved.

Banks and non-banks are leveraging digital technologies to innovate with delivery mechanisms as well as products. Policymakers and regulators are building capacity to leverage opportunities to enhance financial inclusion and to understand incremental risks to financial sector stability and integrity.

Defining E-Money and Mobile Money

E-Money and Mobile Money

- E-money and mobile money have been the most widespread DFS to date.

- Electronic money: E-money is a record of funds or value available to a consumer stored on a payment device such as chip, prepaid cards, mobile phones or on computer systems as a non-traditional account with a banking or non-banking entity.

- Mobile money: A specific e-money product where the record of funds is stored on the mobile phone or a central computer system, and which can be drawn down through specific payment instructions to be issued from the bearers’ mobile phone. Also known as m-money.

The terms e-money and mobile money are used according to the above definitions. In certain cases, country laws, regulations and markets have preferred one terminology with a varying scope.

Reaching The Unserved and Underserved

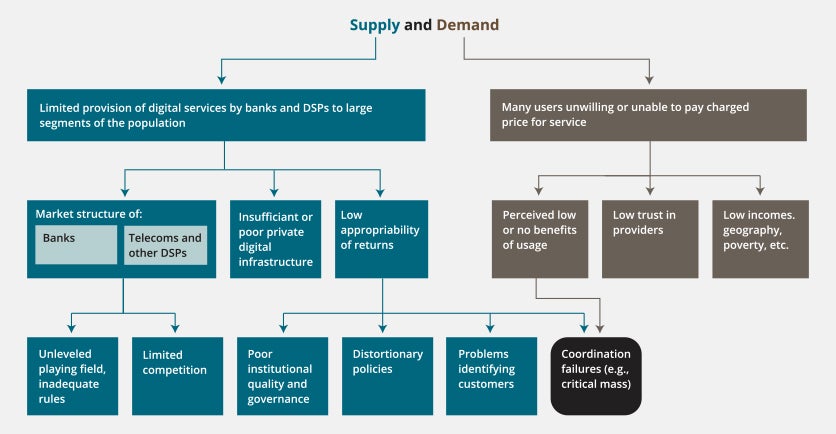

The Center for Global Development's Decision Tree Framework presents a methodology, adaptable to country-specific settings, that will help policymakers, researchers, and other stakeholders to diagnose the binding constraints, the limiting factors, impeding further digital financial inclusion.

- DFS already offer examples of solutions to a range of demand and supply side constraints to financial inclusion.

Achieving Financial Inclusion Goals Through DFS

- Growth in DFS may not be enough to achieve sustainable financial inclusion goals.

- Financial Inclusion Strategies may help contextualize and leverage DFS to achieve financial inclusion targets in each country.

- Financial Inclusion Strategies may also be critical to coordinate efforts across DFS so that policy, regulatory and market reforms have impact.

- Account access and digital payments may provide impetus for other DFS across savings, credit, insurance, investment and financial planning.

E-money and Mobile Money as the Engine of Growth

- E-money and mobile money continue to provide new pathways to open accounts and make digital payments.

- These markets are utilizing underlying growth in connectivity, technology and the digital economy.

- Policymakers, regulators and the private sector have focused on e-money and mobile money.

- Demonstrated scalability of e-money and mobile money offers important insights about the broader DFS landscape.

Country Examples

Countries have adapted a range of approaches based on policy priorities, legal and regulatory frameworks, and market context. Overall, there is growing evidence that DFS is contributing to a new wave of financial inclusion outcomes.

MOBILE MONEY IS DRIVING FINANCIAL INCLUSION

| 2012 | 1H 2019 | |

|---|---|---|

| Registered Mobile Money Accounts | 3.8 million | 32 million |

| Active Mobile Money Accounts | 345,000 | 12.9 million |

| Total Population 15+ | 15.9 million | 19.9 million |

| % 15+ Population with Active Mobile Money Account | 2% | 65% |

% 15+ population with an account increased from 29% (2011) to 58% (2017).

Global Adoption of DFS is Rising

Impact of DFS on Poverty

DFS has had direct impacts on consumption, the ability to cope with shocks and extreme poverty.

From 2008-2014, adoption of mobile money helped approximately 2% of all Kenyan households escape poverty.

Mobile money increased consumption expenditure by 44% when households experienced a flood shock in Mozambique (Batista and Vicente, 2020).

In Northern Uganda, mobile money increased food security by 45% for households that lived far away from bank branches (Weiser et al., 2019).

Basic DFS Enablers

Growth in DFS has expanded the range of actors in the chain of financial services, from design to delivery. The following factors distinguish DFS from traditional financial services in a financial inclusion context: