Overview

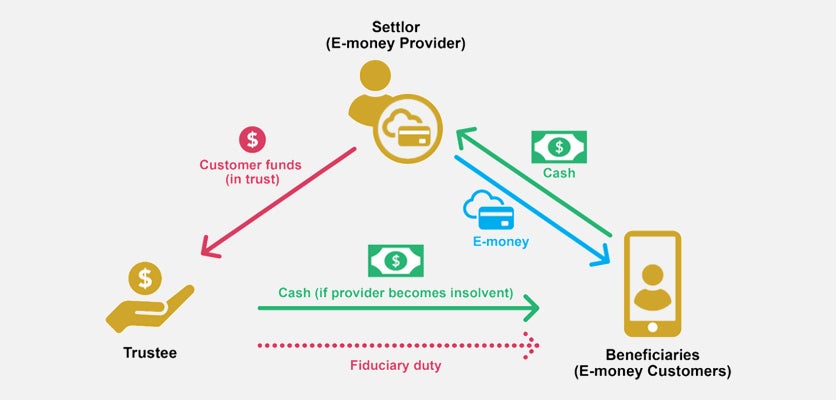

Some countries require e-money issuer to set aside funds in trust (or similar fiduciary instrument) to repay customers. Issuer could be required not to commingle customer funds with issuer’s funds and to legally ring-fence customer funds (i.e., only used to repay customers and protected against credit claims in event of issuer’s insolvency)

HOW TRUST ARRANGEMENTS WORK

Country Examples

Country Examples

E-money issuers are required to maintain customer funds with the central bank and/or store customer funds in autonomous funds managed by a fiduciary in financial institutions in Paraguay authorized by the central bank.

If funds are safeguarded through investment of funds (as opposed to via an insurance policy), funds must be protected against claims from other creditors of the e-money issuer in accordance with national law, particularly with respect to insolvency.

ISSUES AROUND TRUST ARRANGEMENT IN COMMON LAW COUNTRIES

Issue 1

Storing users’ funds in a trust emerged as a key regulatory tool across common law countries. If effectively drafted and implemented, a trust has asset segregation effects – it ring-fences users’ funds from the assets of the e-money issuer. This means creditors cannot access users’ funds during bankruptcy proceedings of the e-money issuer.

Potential Solution

Establishing a trust: A policymaker can require an e-money issuer to take two main steps to support the legality of a trust:

- Require the e-money issuer to use a trust deed, which is a legal document that outlines how the trust relationship between the trustee and users (as ‘beneficiaries’ of the trust) will operate.

- Require that this trust deed contains a declaration of trust. This means the trustee declares that it holds users’ funds (‘trust assets’) on behalf of the users.

Issue 2

The challenge is that many countries require funds to be stored in a trust but provide little, if any, guidance of what should comprise the rules of this instrument and how to ensure that the e-money issuer and/or a trustee complies with them.

Potential Solution

Terms of the trust: Trust legislation can provide guidance on the type of rules that should be involved in a mobile money trust. Such rules comprise ‘trustee duties’ towards users and so, by extension, users’ funds.

Issue 3

Insufficient rules and/or oversight matters because of the potential for commingling, which can make a trust legally invalid. Here commingling means the e-money issuer and/or trustee may mix users’ funds – stored in the trust account – with the firm’s other assets.

Potential Solution

Supervision of the trust: Any trust rules implemented must be monitored and enforced, making supervision important. For example, a public actor can monitor and enforce trustee duties in a mobile money trust on behalf of users, using administrative powers. A regulator could adopt a similar role and could monitor the trust arrangements, checking both compliance with trustee duties and the 1:1 relationship in general.

Issues in civil law countries

Issue

In common law countries, trusts can protect mobile money users’ funds through asset segregation. However, civil countries usually lack a legal framework for trusts, and the legal concept of trust is usually absent.

In the context of e-money, civil countries often state that asset segregation must take place but do not specify an instrument that makes such an arrangement legally valid, which translates these asset segregation requirements into specific obligations. This means that provisions appear to have little or no effect in law.

- Civil law countries need new thinking for asset segregation because trusts are not generally recognized in such jurisdictions.

- Civil law countries may need to consider new tools or a combination of multiple tools that would protect users’ funds in case of issuer’s insolvency. See Greenacre (2020) for some potential tools.